- Date

- 14th February 2022

- Categories

By Jon Leary (MECS), with input from many others

This blog connects a series of market assessment studies produced jointly by Energising Development (EnDev) and the Modern Energy Cooking Services (MECS) Programme. The market assessments offer strategic insights on the current state of electricity access and clean cooking in eight countries across sub-Saharan Africa and South Asia. This includes Kenya, Rwanda, Bangladesh, Nepal, Uganda, Benin, Ethiopia and Mozambique. The studies identify the key opportunities and challenges to scale up electric cooking in the coming decade and conclude with a series of recommendations for targeted interventions that could support the development of emerging eCooking sectors. The market assessments are structured according to the MECS transition theory of change (TToC), which looks into three interrelated dimensions: the enabling environment, consumer demand and the supply chain.

National level market outlooks are available at the bottom of the page.

Why eCooking?

Cooking with electricity presents a transformative opportunity to leverage the progress in electrification to drive forward the clean cooking agenda. Many low- and middle-income countries are making significant progress on increasing access to and reliability of electricity, and shifting towards renewable energy generation in electricity grids. This offers an opportunity to transition large numbers of people from unsustainably harvested biomass to renewable electricity.

A broad range of energy-efficient eCooking appliances are now available, such as the Electric Pressure Cooker (EPC), induction stove and rice cooker. These modern, clean and convenient devices align well with the aspirations of the rapidly urbanising societies in sub-Saharan Africa and South Asia .

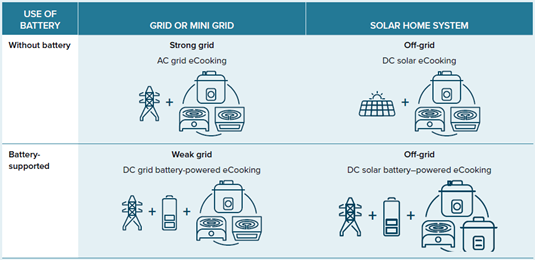

New business models & technologies are now available that can break down the high upfront cost of energy-efficient and battery-supported cooking devices to deliver cost-effective eCooking services to HHs with strong or weak grid connections or in off-grid areas.

Our approach

The EnDev/MECS eCooking Market Assessments were caried out as a series of desk studies collating findings from existing studies, drawing upon the knowledge and expertise of local EnDev/MECS teams (for which we are extremely grateful – please see acknowledgement at the end of the blog). A Framework for Analysis was developed to answer the following key research questions

- What is the market potential for eCooking in this country?

- What are the key opportunities & challenges for piloting or scaling up eCooking in this country?

The analysis explored 3 dimensions of the MECS Transition Theory of Change in detail:

- Enabling environment – including an integrated policy analysis, reviewing the connections (or lack of) between clean cooking and electrification policy.

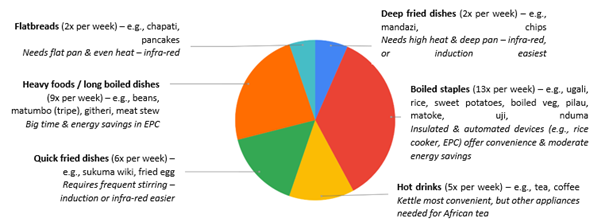

- Consumer demand – including a culinary compatibility analysis, mapping out a typical weekly menu for a household in each country, categorizing the dishes and assessing their compatibility with a range of energy-efficient eCooking appliances.

- Supply chain – including an analysis of the relative costs of cooking with electricity versus popular cooking fuels and an analysis of import data revealing the most popular appliances currently being imported into each country.

The studies also used WHO Benefits of Action to Reduce Household Air Pollution (BAR-HAP) to model the potential impacts of transitioning to eCooking at scale (see Scale up analysis: modelling method and assumptions). The BAR-HAP contains databases of demographics, population health, current cooking methods and national energy systems for LMICs, and technical assumptions for traditional & clean cooking options, inc. eCooking. The impacts it models include costs and changes in subsidies (to the consumer, to government and to other funders etc); health benefits; climate and other environmental impacts; reduction in use of non-renewable biomass; and reductions in time spent gathering fuel. In each country, a key target market segment was identified (e.g. grid-connected charcoal users) and a transition from biomass to eCooking was modelled. The modelling explored the potential impacts if 40% of each segment transitioned from biomass to eCooking (aligned with MECS 40, 60 by 2030 goal).

Emerging trends

The following section explores some of the trends that emerged when comparing between the country studies.

1. Clean cooking and electricity access

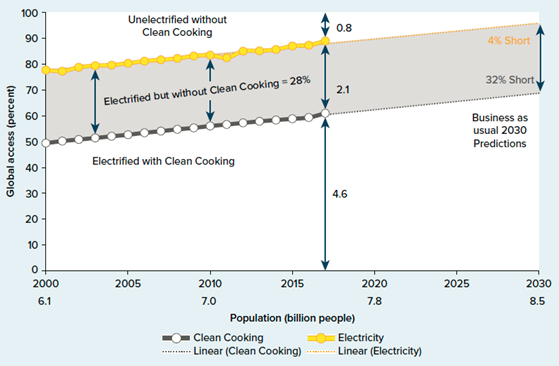

In 5 of the 8 studied countries, the majority of the population is now electrified, yet still cooks primarily with polluting fuels.

In these countries, there is a clear opportunity for a rapid transition to eCooking at scale, which could be accelerated by strategic interventions to raise consumer awareness, develop supply chains & create an enabling environment.

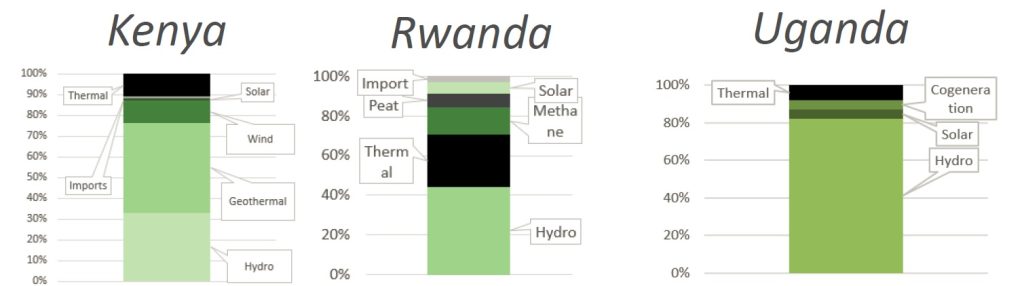

In 3 of the 8 countries, electricity is already generated from a diversified blend of predominantly renewable generation and surplus reliable electricity is available.

In these countries, there is a clear opportunity to support the utility to develop and scale an eCooking demand stimulation programme. In Kenya, the national utility company, Kenya Power and Lighting Company (KPLC) have already set up the Pika na Power programme to promote cooking with electricity (meaning Cook with Electricity). Uganda’s main electricity distribution company, Umeme, are laying the foundations for a similar programme.

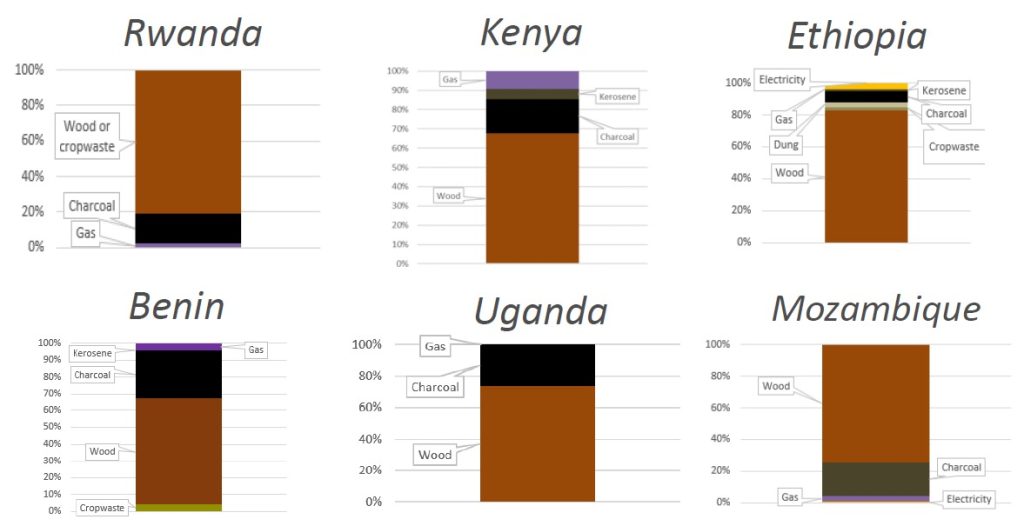

In all 8 countries, there is widespread use of polluting fuels that may or may not be purchased, e.g. wood, crop waste, dung. However, in 6 countries, there is substantial use of ‘commercialised polluting fuels’, e.g. charcoal, kerosene. These fuels are almost always purchased and therefore offer an existing expenditure that could be converted into electricity units and repayments on a financed energy-efficient appliance. This is a much more attractive proposition than persuading those who aren’t yet paying for their cooking fuel to start paying for eCooking.

Even though these market segments may be more attractive, it is still important to carry out market research to understand how much and how frequently people are paying for these fuels and what the cost savings are likely to be from shifting to eCooking, so that appliance financing schemes can be designed accordingly.

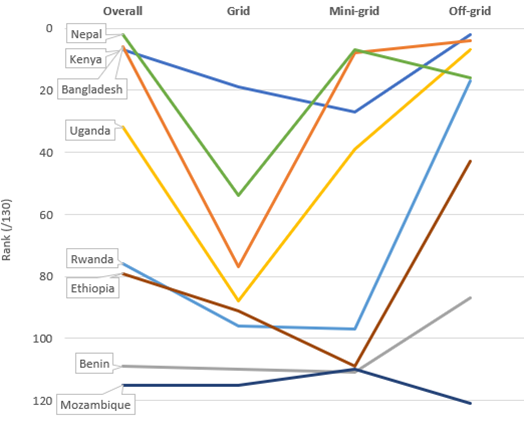

These findings are in line with a previous study to better understand the viability of a scale up of eCooking across the global south. The MECS eCooking Global Market Assessment (GMA) scored and ranked all low- & middle-income countries using international indicators for:

- Economics (clean fuels, market size, financial sector strength)

- Human (policy, health, gender, development, business environment)

- Infrastructure (electricity access, reliability, RE share)

The resulting scores and ranks indicate the viability of eCooking in grid-connected, mini-grid and off-grid regions.

Kenya stands out as scoring highly across the board (7th overall), however, Nepal and Bangladesh score even higher (2nd and 6th overall) due to very high scores in both the mini-grid and off-grid analyses. Rwanda and Ethiopia also both scored high in the off-grid analysis.

2. Impact modelling

The BAR-HAP impact modelling revealed 3 different types of countries:

- High impact across the board: Uganda, Rwanda, Kenya, Ethiopia and Mozambique all have substantial populations dependent upon charcoal, much of which is unsustainably sourced & inefficiently burned charcoal. Meanwhile, electricity generation is predominantly renewable and electricity tariffs are moderate/low. As a result, there are high potential impacts in all categories. For example, in the case of Rwanda, if 40% of grid-connected charcoal users (2.9m ppl, 0.7m HHs) switched to eCooking, BAR-HAP suggests that:

• 669 DALYs/yr would be avoided

• 0.54m tonnes/yr CO2eq emissions would be reduced

• there would be a 0.21m tonnes/yr reduction in unsustainable wood harvest

• 133m hrs/yr of women’s time would be saved (191hrs/HH/yr)

• there would be a 14-month payback for eCooking appliances ($80/HH upfront cost, $75/HH/yr savings on fuel energy costs)

• 236 GWh demand for electricity would be stimulated. - In Nepal & Bangladesh, there is minimal use of commercialized polluting fuels, so grid-connected firewood users were targeted. In both countries, there is a high usage of unsustainably sourced and inefficiently burned firewood, as well as moderate/low electricity tariffs. In Nepal, electricity is generated almost exclusively from hydro, whilst in Bangladesh it is almost entirely fossil fuel based. However, both countries still showed high potential impacts across the board as Bangladesh uses gas to generate electricity, which a less carbon intensive fossil fuel than coal or oil.

- In Benin charcoal is widely used, however deforestation/forest degradation is less of a challenge than the other countries studied, and charcoal prices are therefore lower. Meanwhile, electricity generation is dominated by imported fossil fuels (mostly oil) and the utility charges a higher electricity tariff than the other countries. As a result, the modelling suggested negative carbon impacts (i.e. an increase in emissions), no payback on appliances (as there were no cost savings from switching to eCooking), a minimal impact on deforestation/forest degradation and only moderate impacts health and women’s time.

3. Policy environment

Nepal stands out as the only country of the 8 that has already developed a strong integrated framework that connects the clean cooking challenge with progress in electricity access. An eCooking tariff is already available to Nepali households and the government has a target of 25% of the population using electricity as their primary cooking fuel by 2030. However, there are also promising signs in Kenya, Uganda and Ethiopia, with policy makers starting to make connections between the previously separate clean cooking and electrification sectors. There is an important role for development partners in supporting the development of an integrated energy policy, facilitating South-South exchange and feeding the learnings from eCooking pilots into the policy development process.

4. Consumer demand

The culinary analysis of weekly menus revealed a high prevalence of stews & ‘heavy foods’ (long boil), in particular in the East African nations (Rwanda, Uganda, Kenya, Ethiopia).

The EPC makes cooking these types of dishes much more convenient and offers big savings in time and money. This means that there is a clear opportunity to promote EPCs as part of a clean fuel/appliance stack in these countries.

5. Supply chain

In Ethiopia, eCooking is already widely adopted as a primary cooking fuel. It was promoted by the Government in the 1970s and 4% of the population now use it as their primary cooking fuel. Domestic manufacturers are already producing appliances tailored to local cuisine, so there is an opportunity to support domestic manufacturers to develop more energy-efficient appliances (e.g. with innovation challenge fund) as tariff increases are gradually being enforced.

In 3 of the countries, eCooking is already widely adopted as secondary cooking fuel. In particular rice cookers in Nepal & Bangladesh and amongst urban households in Mozambique. However, these appliances are more accessible to wealthier households, so there is an opportunity to support the network of importers/distributors already supplying eCooking appliances to target low-income households by piloting innovative consumer financing models (e.g. targeted Results Based Financing).

In the remaining counties, (Kenya, Uganda, Rwanda and Benin) there is an emerging eCooking market, which could be supported by encouraging the existing network of importers/distributors to add eCooking appliances to their product range (e.g. with RBF).

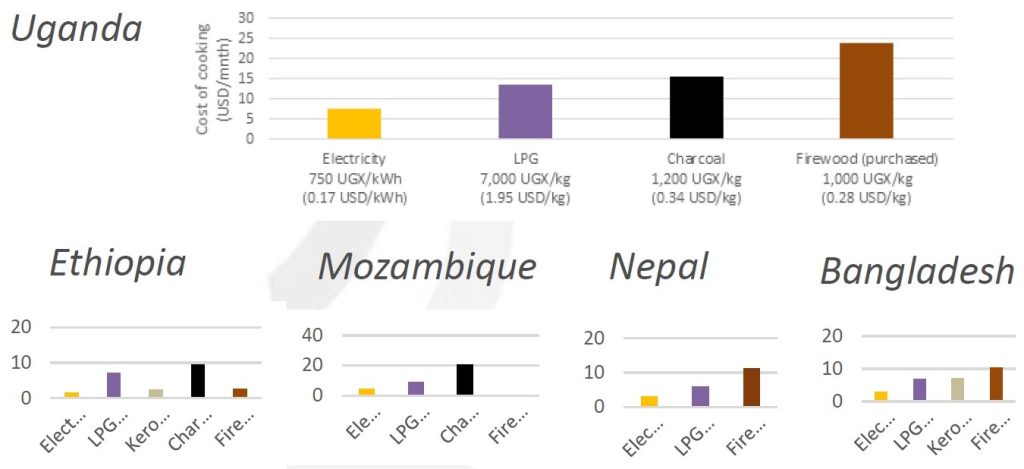

6. Relative costs of cooking

In 5 countries, the relative cost analysis suggests that cooking all your food with electricity is already the cheapest way to cook (except compared to collected fuels, such as firewood, crop waste and dung).

In these countries, development partners could support consumer awareness campaigns to challenge the false perception that electricity is ‘too expensive for cooking’ and support the development and piloting of consumer financing mechanisms to reduce the high upfront cost of energy-efficient appliances.

Key takeaways

The clean cooking challenge, the state of electricity sector and therefore the opportunity for eCooking is different in each context. However, there are similarities and therefore similar interventions can be effective in countries with similar characteristics. There are opportunities for eCooking in all the countries studied, however Nepal, Rwanda, Kenya, Uganda and Ethiopia stand out as countries conducive for a rapid transition to eCooking at scale. This could make a substantial contribution to SDG 7 by leveraging progress in electrification to drive forward the clean cooking agenda.

Acknowledgements

Finally, we conclude by thanking the many researchers and practitioners who contributed their time to these studies, drawing in a wealth of knowledge and experience:

- EnDev eCooking Team: Simone Fehrenbach, Gregor Broemling and Verena Brinkmann

- MECS Link Researchers & Workstream Leads: Iwona Bisaga, Bridget Menyeh, Carlos Sakyi-Nyarko, Susann Stritzke, Vimbai Chapungu, Richard Sieff, Meron Tesfamichael, Martin Price, Karin Troncoso, Melinda Barnard-Tallier, Matt Leach, Nick Rousseau and Simon Batchelor

- EnDev Country Teams: Rwanda (Isabella Troconis and Emile Babu), Mozambique (Micas Cumbana, Maria del Rosario and Alexander Fischer), Kenya (Walter Kipruto and Anna Ingwe), Ethiopia (Christian Borchard, Zewdy Gebremedhin and Samson Tolessa), Nepal (Daniel Fuchs), Uganda (Victoria Butegwa, Helen Kyomugisha, Pia Hopfenwieser and Florent Eveille), Benin (Guillaume Edmond Tchenga and Mario Merchan Andres), Bangladesh (Henrik Personn, Zunayed Ahmed and Sen Sajib)

- MECS Country Teams: Rwanda (Herbert Njiru and Divin Ntivunwa), Kenya (Joanes Atela, Tom Randa, Victoria Chengo, Joel Onyango, Syprose Ochieng, Mourine Chepkemoi and Paul Osogo), Nepal (PEEDA, Winrock, Practical Action, Practical Action Consulting, IRADe and Energia (Hivos)), Uganda (Agnes Naluwagga), Bangladesh (Rezwhan Khan, Uttam Kumar Saha and Sabbir Ahmed)

Resources

Access the GMA visualisation tool and further resources here.

EnDev and MECS co-organised a webinar to present the key findings of the eCooking Market Assessments. Please click here to access the presentations:

See below for the recording of the session:

National level market outlooks

- Kenya is the birthplace of mobile money and a hotbed for innovation in the development sector.

- Many of the new electric cooking technologies and business models developed by MECS are being piloted in Kenya, where they are able to leverage the ecosystem of actors and the strong enabling environments in the converging clean cooking and electrification sectors.

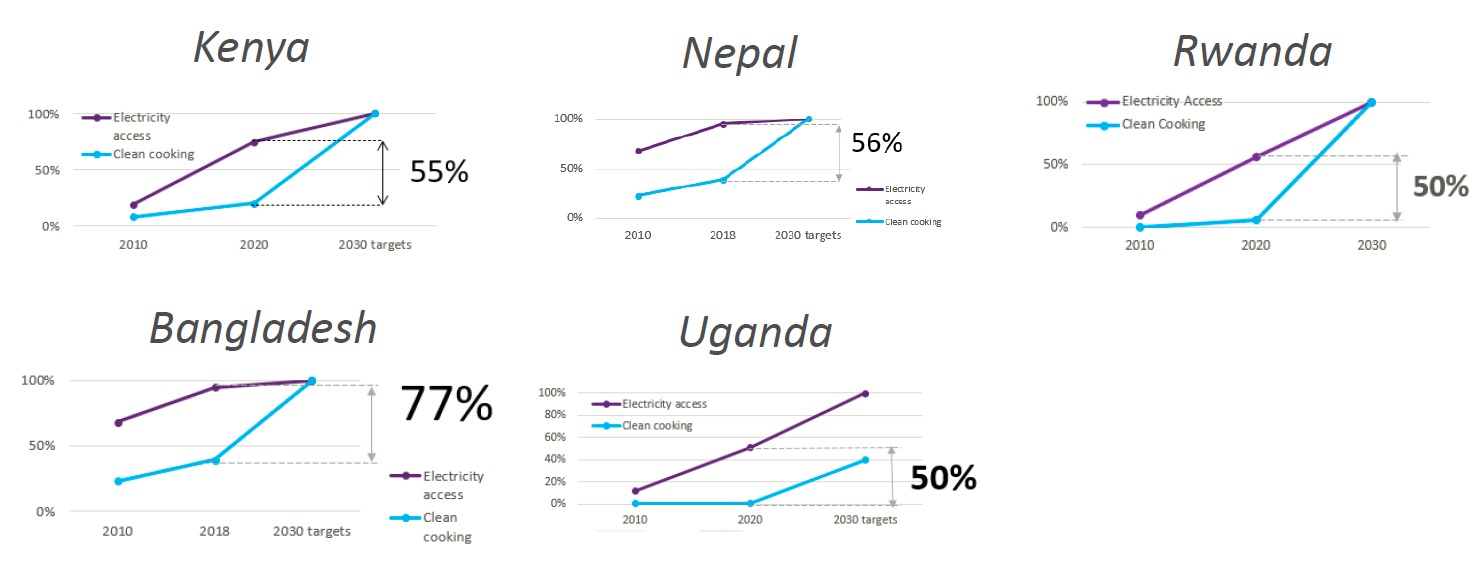

- Kenya has made enormous progress on electrification with coverage increasing from 19% to 75% in just 10 years, and the majority of its grid electricity is generated from renewable sources, mainly geothermal and hydro.

- However, most of the population still rely on polluting fuels such as firewood, charcoal and kerosene for cooking.

- Currently 0% of Kenyans use electricity as their primary cooking fuel, meaning that there is an enormous untapped potential for electric cooking, which is increasingly drawing the interest of the government, consumers and the private sector.

- Over the last decade, Rwanda has been enjoying strong economic growth rates, creating a favourable environment for new businesses and lifting people out of poverty.

- The Government of Rwanda are actively working towards economic development and reforms in the financial and business sectors which is demonstrated in the country moving from 139 to 38 on the annual World Bank Doing Business Report between 2010 and 2016.

- A lot of progress has been made on electrification with coverage increasing from 10% in 2010 to 66.8% in 2021. The total installed generation capacity in Rwanda is currently 235.6 MW (11% imported, the rest domestically generated: 50.6% hydrological resources, 43.3% thermal, and 5% solar).

- However, most of the population still rely on polluting fuels such as firewood and charcoal for cooking.

- Currently 0% of Rwandans use electricity as their primary cooking fuel.

- Rwandan cuisine is largely compatible with electric cooking appliances, such as Electric Pressure Cookers (EPCs) and rice cookers therefore there is a high potential to transition households to incorporating electric cooking in the fuel mix in the coming years.

- The Government of Rwanda and the private sector have expressed an interest to pursue this opportunity, however, it is currently in its early stages.

- Bangladesh became a lower-middle-income country in 2015 and is one of the most densely populated countries in the world with over 160 million people (64% of which live in rural areas).

- The country has made rapid progress towards universal electrification with 99% of the population having access to electricity.

- Grid electricity is very cheap, but still unreliable. Despite surplus electricity on the grid as a whole, several regions still experience load shedding, and only 2% is from renewable sources.

- Bangladesh has world-leading mini-grid and off-grid scenarios (ranked 8th and 4th respectively on the MECS eCooking GMA).

- 77% still lack access to clean cooking. This is not currently prioritised by the national government and does not connect with the electrification policy.

- Biomass (fuelwood) remains a popular cooking fuel choice, especially in rural areas.

- Gas (both PNG and LPG) are already widely adopted and eCooking is gaining in popularity, but mainly as a complimentary rather than a primary cooking option.

- The Government of Nepal has adopted an integrated electrification-clean cooking approach with a 2020 NDC target of 25% of all households using electricity as a primary mode of cooking by 2030 and a dedicated eCooking tariff already deployed.

- The country has made massive strides in its electrification with current access close to 95% of which 71.7% of households are connected to the grid and 23% off-grid.

- The Government of Nepal declared 2018-2028 as the Decade of Energy and Hydropower to realize the dream of ‘Prosperous Nepal, Happy Nepali’ and included in this was the aim to provide electricity access to every household by 2022.

- Yet 52.4% of households still rely on firewood as their main fuel for cooking (35.4% urban; 65.8% rural). Currently 0.4% of Nepali households use electricity as their primary cooking fuel.

- The country’s increasing investment in renewable generation capacity and expected surplus capacity means that cooking with electricity is a viable option (and will become increasingly so), particularly for those connected to the grid.

- In 2020/21, the Government of Nepal’s Alternative Energy Promotion Centre (AEPC) announced it goal of promoting e-cooking in 100,000 households and the Nepal Electricity Authority (NEA) has launched a dedicated eCooking tariff to support this.

- Despite historically low electrification rates, cooking with electricity is now becoming a viable and scalable option for Uganda.

- 24% of households now have access to grid electricity and 27% use off-grid sources such as solar systems.

- Significant investment in generation capacity has helped to mitigate against the country’s dependency on hydropower, which in 2005 led to significant, drought-induced load shedding and power outages.

- The total installed generation capacity doubled from 600 MW to 1200 MW between 2010 and 2019. Uganda today produces an electricity surplus of almost double current demand and is proactively stimulating demand for its predominantly renewable (92%) electricity.

- 21% of Ugandans use charcoal as their primary cooking fuel, however intensive charcoal production is depleting forests. Charcoal users are an attractive market segment to target as they have a guaranteed existing expenditure on a polluting fuel that could be repurposed to electricity units. The anticipated population growth, which is set to double the total population by 2050, increases the need for an alternative and more sustainable fuel source.

- As a result, the Government of Uganda has put in place an array of policies and targets to facilitate the transition away from biomass, including the Draft Energy Policy (2019), which made specific mention of energy-efficient eCooking appliances.

- Benin has an electrification rate of around 41% and clean cooking access rate of around 6%, meaning that 35% of the population now have access to electricity, but are still cooking with polluting fuels.

- Clean cooking has been addressed by a few programmes in the past, but they were all focused on improved biomass cookstoves (ICS).

- Benin shows significant potential for the uptake of eCooking, especially among urban, middle-class households as the uptake of e-cooking in these segments is very low despite having access to electricity.

- Beninese consumers seem to be very interested in modern energy cooking including eCooking and the many dishes of the Beninese cuisine seem to be compatible with e-cooking solutions such as EPCs.

- A challenge for eCooking is the high price of electricity per kWh in comparison to the price of charcoal and the power outages.

- The eCooking supply-chain and market distribution is at a very nascent stage which means that supporting local supply-chain management and business-model development for small- and medium-sized businesses flanked by a consumer awareness campaign, especially in urban areas, could significantly increase the uptake of eCooking in these areas.

- Electric cooking (eCooking) has been a feature of Ethiopian cooking practices since the 1970s when government programmes promoted eCooking appliances (particularly electric injera stoves) to create demand for surplus power and reduce the environmental impacts of biomass consumption.

- Yet, the majority (96%) of Ethiopia’s population of 115 million (22% urban) still relies on polluting fuels for their cooking needs, with firewood most used (82%).

- Over the last decade, there has been a rapid increase in the use of electricity for cooking in urban areas. Given the very low Ethiopian electricity prices and ongoing support from government programmes for eCooking, it is perhaps surprising that only 4.1% of all households use electricity as their primary cooking fuel.

- The ambitious plans to increase electricity access from the current 45% to 100% by 2025 offer further opportunities for eCooking going forward. However, issues related to electricity coverage and reliability must be addressed, and policy needs to better integrate electrification and clean cooking in order to increase uptake and unlock the potential for eCooking in Ethiopia.

- Improved access to finance/payment plans could increase the affordability of electric stoves.

- The market potential for eCooking in Mozambique is growing rapidly given the upward rise in the proportion of the population with access to electricity, which has doubled, from 17% in 2009 to 34% in 2020 (ALER, 2021).

- Mozambique has an emerging eCooking sector, with 1.4% of the total population already cooking primarily with electricity (WHO, 2020).

- Access to electricity and eCooking is concentrated in urban areas, with 73% of the urban population now connected and UNDP (2020) reporting that 17% of the urban population cook with electricity.

- Mozambique’s low electricity tariff ($0.10/kWh) means that eCooking is already the most affordable option, even without considering the generous lifeline tariff for households with low consumption ($0.02/kWh < 100kWh/month). Issues related to reliability and access, in particular in rural areas, hinder greater uptake. However, there is an opportunity to pilot battery-supported and solar-powered cooking.

- Further study of the existing eCooking market in urban areas involving primary research is needed to inform potential future interventions. This could focus on gathering data to get a deeper understanding of the key actors in the eCooking value chain and the key market segments that have already adopted eCooking.