- Date

- 15th February 2024

- Categories

- Clean Cooking, COP28, Electric Cooking

2nd of the 3 blog series

By Dr Samir Thapa, MECS Programme, Loughborough University

This is the second blog as part of a series of three blogs that looked at COP28 reflections from a cooking transition perspective. This blog synthesises relevant COP28 decisions and discussions on the means of implementation; finance, technology, and capacity building for just cooking transitions. This blog and the other two in the series are however based on a purposive review and participation of/at 44 relevant sessions, not including the negotiation.

There were several notable high-level funding and financing announcements for cooking transition e.g. UNCDF managed Cooking Fund with EU support of US$ 21 million for Tanzania. Perhaps one of the most impressive announcements was by the World Bank who approved the week before the ASCENT programme (US$ 5 billion crowding in a further $10B) which brings together improvements in access to renewable electricity with possibilities for eCooking. Finance Day Presidency event emphasised the delivery of finance that is available, accessible, and affordable with better, bigger, and bolder financing institutions. High level discussions around financing architecture emphasised frameworks with social contracts and sustainability for ambitions beyond marginal costs, market self-correction and contracts. Climate change was often viewed as a wicked problem unsolvable only by the governments and private sector. This clearly related to the ongoing developments and discussions on cooking transitions, especially in relation to leveraging carbon credits 1. Participants underscored pitching credits both as a financing instrument as well as a commodity with multiple benefits. They represent different instruments in the global climate finance eco-system e.g. Modern Cooking Facility for Africa, Green Climate Fund 2, ETSs 3, Carbon Taxes, including market signals, insurance and exchanges.

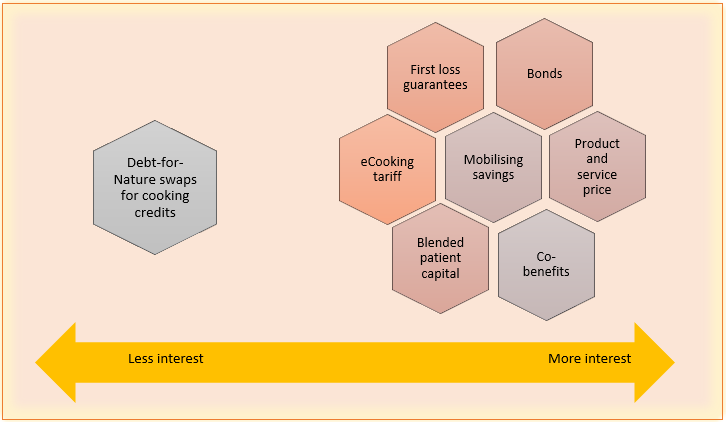

Some country representatives (e.g. Kenya, Ghana) expressed the need for a fine balance between benefit sharing and catalysing investment, and in general between regulation and innovation – as early lessons learned 4. Whilst many participants still considered benefit sharing within the realm of either up-front subsidy and/or non-cash incentives e.g. Nigerian Sovereign Investment Authority, others pointed out the need for elaborated Free-Prior-Consent and equitable governance procedures. This would help agreements to be voided, especially if indigenous communities and/or human rights violations are involved. Developing country participants expressed less interest in new discussions e.g. around Debt-for-Nature swaps linked to cooking transitions but rather preferred localised financing solutions. These included mobilising savings such as with 5 the eCooking tariff (e.g. Kenya), first loss guarantees 6 for small ticket sizes (e.g. Uganda), bonds 7 and blended patient capital including fair and adequate pricing of products, services, including for credits and co-benefits generated. Kenya representatives mentioned that such could then provide the required fiscal space for countries to pay back their debts – as Kenya was struggling to balance its new cooking tariff with their obligations to service international debt.

Participants mentioned availability of a diverse set of cooking solutions and distribution models for various pathways to cooking transitions with comparatively lesser concerns compared to financing and capacity development. The one exception was events on the use of hydrogen for cooking, carbon credit ratings, and smart grid/mini grid for just cooking transition which could have been useful in the longer term.

Institutional cooking, particularly for school feeding was a clear winner (e.g. Nepal, Kenya and Uganda) for which regional carbon projects 8 were already in the pipeline. In this, the need for understanding the state of energy access for multiple institutional archetypes was emphasised. This included robust baselines, availability of commercial/institutional e/Cookers, grid stability and creating awareness about niche benefits such as nutritional benefits of pressure cooking. Linking initiatives such as School Meals Coalition to the ongoing localised manufacture for job-creation was also cited e.g. Burn Manufacturing 9. Women’s ability to steer the sector was central in many discussions e.g. women agent’s sales volume, success of women-owned/led business (e.g. Koko Networks) including government representatives (e.g. Tanzania’s President, Uganda’s Ministry Representative).

Another important event highlighted the work group activities around digitising the standard carbon market components of project development (e.g. web application for methodologies), impact certifications (e.g. dMRV protocol), and national and international registry systems (e.g. Vanuatu) for credit trade and transfers (e.g. blockchain and tokens) and harmonisation of registries (e.g. Carbon Action Data Trust). Participants expressed the immediate need to pilot the end-to-end digital platforms, now that the minimum working modules are ready – possibly in the cooking sector. This could lead to an iterative process depending on the country infrastructure. Participants were though cautious about the costs compared to robust survey and sample sizes. Importantly, government representatives were hopeful that these developments would help localise the value chain of cooking and associated technologies e.g. electric pressure cookers for increased rural/remote access. Expectations were for real-time digitised revenue to be credited as the clean and modern cooking solutions are used.

Events and participants called for a diverse and context specific capacity building programs for governments/non-governments, experts, projects developers, and communities/individuals. This would help navigate the regulatory, institutional, organisational, and technological needs, especially for LDCs and SIDS (e.g. Sri Lanka, Somalia). So far, 46 NDCs have expressed interest to engage in carbon markets, and cooking transitions are conditional with majority NDCs, e.g. Uganda, Ghana, Kenya, Tanzania, Malawi. Uganda mentioned the need for disaggregated and digitised data from multiple private and public sources e.g. for designing eCooking tariffs. Kenya mentioned the importance of initiatives to prepare cooking and eCooking transition strategies. Participants also mentioned the need of standards for commercial/institutional cookers – including for repair and maintenance, peer-to-peer learning such as for accessing GCF funds (e.g. between Uganda and Nepal), and activities to reflect cooking transition in the relevant sector/ministry plans. These activities would require linking with the preparation and implementation of carbon financing regulations/framework, guidelines, and registries (e.g. Bhutan); supported with advanced research, summer schools and internships.

Representatives from Verra, Vanuatu, Sweden and Switzerland expressed the capacity needs both on the demand (e.g. use of credits) and supply side (e.g. project development). Switzerland mentioned facing a steep learning curve with Paris Agreement Article 6.2 implementation. Others (e.g. Mozambique, Nigeria, and Ghana) mentioned internal capacity building and preparations for dialogues e.g. identifying areas/sector, developing legislations, and establishment of critical parameters e.g. fNRB. These countries mentioned missing the Clean Development Mechanism (CDM) opportunities and having to play catch up with the voluntary market. Several bilateral and multilateral organisations (A6P, GGGI, NDC Partnership, WB, ICVCM, GS, ACMI, VCMI) informed about their work and intention to engage in this space. However, many were focused on engaging extremely busy government actors, participants (e.g. India, VCMI) expressed the need for building the eco-system and stop duplication of works. Indigenous representatives expressed concerns of severe lack of engagement. Important considerations for capacity building were also around innovations and ambitions e.g. policy and sectoral crediting, fragmentation around mechanisms (e.g. share of proceeds) and methodologies, conditions of authorisations (e.g. local manufacturing), and harmonising the diversity of NDCs for transparency – all important with respect to cooking transitions.

In the next related blog, we will synthesis relevant COP28 decisions and discussions specifically with respect to the carbon market.

***************************************************************************************************************

Footnotes:

1 Out of around 1.5 billion tCO2e expected by 2030 – 900 million tCO2e will be from Africa.

2 However, ongoing GCF recipients mentioned that developing carbon projects is not allowed.

3 India has plans for an ETS linked to domestic carbon market for its hard to abate sectors. EU ETS could also start linking to Article 6, with removal credits starting 2026.

4 Tanzania’s recent amendments to its carbon market regulation exhibits changes to benefit sharing clauses with REDD+ revenues earmarked for clean cooking.

5 Kenya representative mentioned eCooking is cheaper by 60% or more compared to charcoal, LPG, and firewood.

6 The World Climate and Nature Guarantee Facility earmarked 100 billion as first loss guarantee for nature-based solutions for the next fifteen years.

7 Burn Manufacturing mentioned issuing a clean cooking bond of US$ 10 million.

8 Verst Carbon is developing a carbon project on school feeding programs in East Africa – aggregating 30,000 schools over the next 5 years.

9 Burn Manufacturing is vertically integrated with full manufacturing facility in Kenya and ongoing assembling plants in Ghana, Mozambique, Tanzania, and Zambia.