- Date

- 23rd February 2022

- Categories

By Richard Sieff (Loughborough University) and Amey Bansod (iDE).

Introduction

If purchased or made available, people in Cambodia consistently choose to cook with electric cooking (eCooking) devices. This is the clear message from the six-month MECS Electric Cooking Outreach (ECO) pilot study carried out by the international non-profit organisation, iDE. The pilot found that people preferred the taste of food cooked on electricity (including the staple rice) and that eCooking was far cheaper than using LPG or charcoal, supporting previous studies that show eCooking fits local cooking practices. Given these benefits, the question remains: how to convince more people to buy an eCook device and move away from cooking with biomass which causes 12,000 premature deaths in Cambodia each year from the resulting household air pollution (ADB, 2015).

The 5Ps Marketing mix

To address this question, iDE used the ‘5Ps’ (Product, Price, Promotion, Place and People) marketing framework to understand how iteratively adjusting the marketing mix could facilitate sales of eCook devices. The framework simplified the complexity of an iterative sales project, guiding decision making on which 5Ps needed to be refined and how. These adjustments were informed by sales data and feedback from customers and non-customers using qualitative (surveys, interviews) and quantitative (usage data) methods.

During the study, 928 people were pitched to: 59 (6.3%) became customers with 71 products sold. Sales were constrained by Covid-19 restricting access to customers but improved significantly during and after the pilot as marketing adjustments were refined.

Product

eCooking is already familiar in Cambodia through the widespread use of electric rice cookers, which pointed to the potential for the pilot to market test other efficient eCook devices to meet additional cooking needs. The devices tested were: single and double induction stoves, electric grills, electric pressure cookers (EPCs), and multicookers.

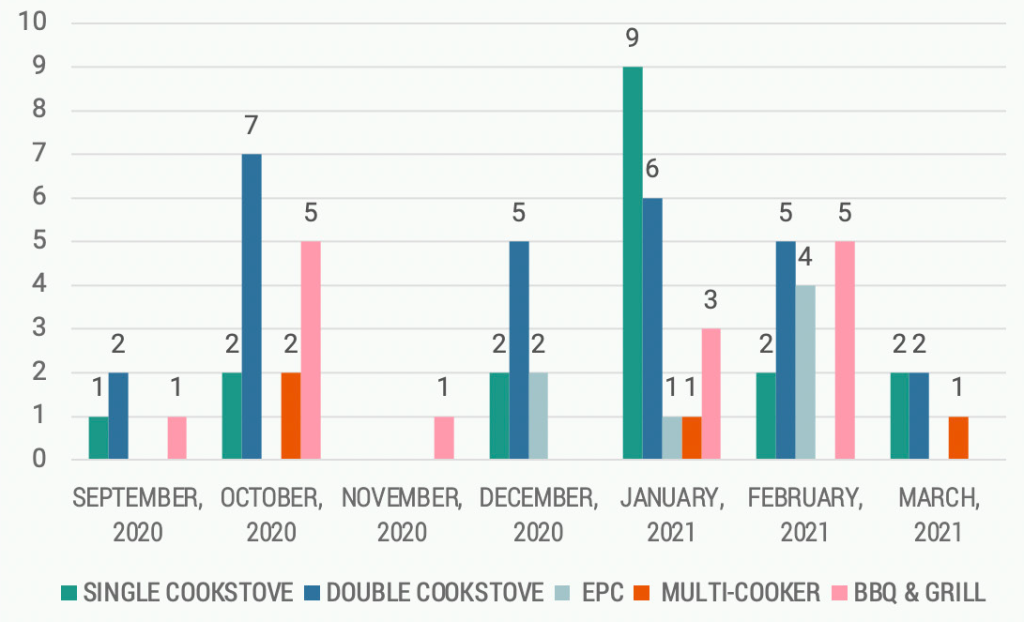

Induction stoves were by far the most sold device (47 of the 71 sales), proving versatile, affordable and aspirational, while enabling customers to cook most everyday dishes without challenges. 68% of non-customers surveyed also indicated interest in purchasing an induction stove in the future. Sales of other devices were more difficult. The electric grill (14 sales) was seen as a convenient alternative to charcoal grilling but too small. EPCs (6 sales) were challenging to sell as both sales agents and customers lacked understanding of the functions and buttons to cook different dishes: many perceiving (and customers often using) the EPC as an expensive rice cooker. Limited functionality (steaming and boiling) of the multi cooker and the small size led to only four sales.

Price

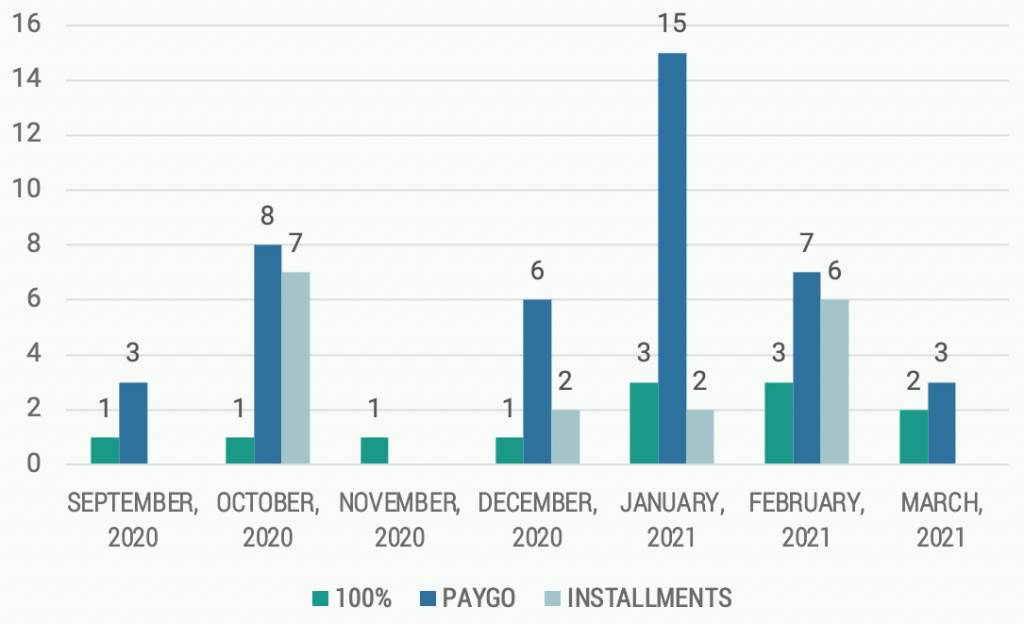

Reducing monthly payments for all devices (by offering longer payback periods) and free month-long trials for induction stoves were the marketing refinements with most impact on sales. Both were introduced in January, significantly increasing sales (Figure 1). Overall, 83% of products were sold via flexible payment mechanisms (PAYGO or credit instalments), highlighting the importance of financing for overcoming upfront cost barriers (Figure 2). The free trials also generated interest during sales pitches, permitting sales conversations to develop which had often previously stalled due to concerns over price and the unfamiliarity of some eCook devices. The offer reduced barriers to entry by enabling people with negative past eCooking experiences to see newer devices were a marked improvement on older models.

Promotion

Due to the interest generated from pricing experiments (above), lifetime cost comparisons for different cooking fuels (e.g. appliance, fuel, and maintenance costs) were calculated and integrated into sales pitches. Comparisons showed significant savings with eCooking, mainly because fuel costs were approximately half those of LPG and charcoal (Table 1). Integrating these comparisons positively impacted sales conversations and likely contributed to the improved sales towards the end of and after the pilot. To address safety (the other main customer concern), sales agents showed customer satisfaction surveys during pitches which highlighted that previous customers felt eCooking was safe.

| eCooking | LPG | Charcoal |

|---|---|---|

| 6$ | 11.25$ | 14$ |

However, by far the most common reason cited for not purchasing an appliance was the need to first have a family discussion (81% of non-customers). In response, sales agent working hours were adjusted to accommodate weekend sales pitches. This facilitated family buy-in and far quicker decisions to purchase as the whole family was present and able to engage in the complex decision-making surrounding the purchase of an eCook device and a new way of cooking.

People and place

Alongside innovator and early adopter customer types, the project revealed grandmothers and stay-at-home mothers as a likely key customer base; the two groups used eCooking appliances the most while elders drove decision making regarding fuel and appliance choices.

Also key are the people selling. Door-to-door marketing was conducted by sales agents from Hydrologic (iDE’s clean water social enterprise subsidiary), whose local water filter sales and distribution network helped reach customers; although retraining agents to understand eCook products and identify customer types slowed sales. Community cooking events, live demonstrations, and engaging customers with video content also proved effective at triggering sales.

Digital marketing

Digital advertising approaches were also market-tested, with most traffic generated by targeting Facebook groups for house appliances, recipes, and cosmetics. Simple, easily visualised messages on ease and convenience worked best. For instance, ‘eCooking frees up time to watch TV programmes’, which targeted the key stay-at-home mother and grandmother customer segments. More abstract messages on being a ‘supermom/gran’ did not gain traction as audiences were unclear what a ‘supermom’ was. Digital advertising helped create product awareness but converting to direct sales proved challenging.

Conclusions and what next?

The evidence base from this project highlights how getting the marketing mix right can convince people of the affordability, ease and convenience of eCooking (the benefits which resonate most with customers) and accelerate sales of eCook devices. Integration of these key learnings (Table 2) has seen sales increase threefold post-pilot. To further increase uptake in Cambodia, research is required to see if these marketing insights are also applicable to last-mile households most affected by the health, time, and economic impacts of cooking with biomass. Innovative financing mechanisms (e.g. carbon financing, smart subsidies) and awareness raising programmes can also help reach these most-in-need households.

| 5P | Key Refinements |

|---|---|

| Product | Induction stoves (single and double) |

| Price | Flexible financing mechanisms, Reduced monthly payments, free trials |

| Promotion | Incorporating cost comparisons into pitches, weekend pitches |

| People & Place | Grandmothers/stay-at-home mothers, sales agent training on products and customer types, utilising local agent networks, live cooking events |

For more information on this study, the iDE ECO final report is available on the MECS website.

……………………………..

Featured image, top: Potential customers cooking and trying food on an electric grill. These kinds of interactive community cooking events hosted at local restaurants with local chefs proved effective at triggering sales (image credit: Bansod, 2021).