- Date

- 17th November 2021

- Categories

By Susann Stritzke and Malcolm Bricknell (Loughborough University).

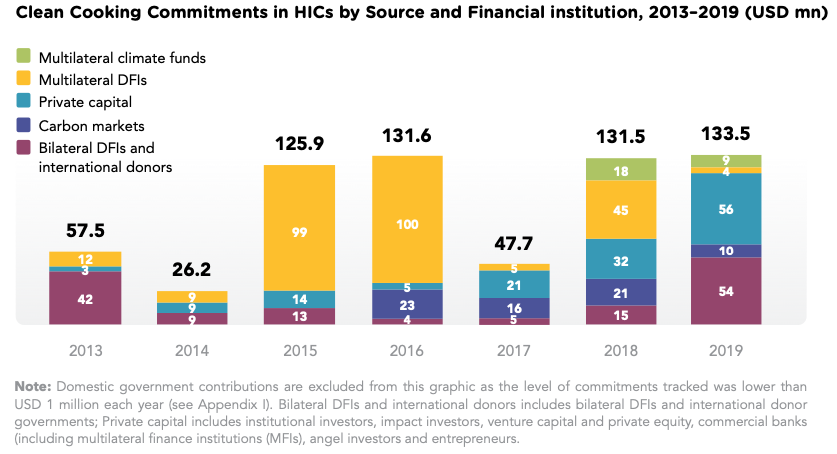

The latest “Energizing Finance Report” by SEforAll has not only again illustrated the significant funding gap for clean cooking access (133mio USD committed in 2019 vs. 4.5bn USD required), it has also shown, that the share of carbon financing for clean cooking remains relatively small and has even decreased from 2016 to 2019. Consequently, the volume of the carbon market for household devices which is dominated by cookstoves, decreased by 40% annually from 6 MtCO2e traded in 2019 (6% market share) to 3.5 MtCO2e in 2020.

The contribution of carbon finance to the clean cooking sector in 2019 of around 10mio USD in 2019, however, is now mirrored by a global (voluntary) carbon market which is on track to achieve 1bn USD in transactions in 2021 and earlier this year, the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) estimated the potential increase of carbon credits by factor of 15 (or more) by 2030 (and even by factor 100 by 2050) which could translate into a market value for carbon credits of 50bn+ USD in 2030. In short, the voluntary global carbon market is sky-rocketing and has transformed from a buyer’s market to a market in control of the seller. This provides significant (and yet largely untapped) financing potential for the modern energy cooking market.

Carbon credits have historically been an attractive source of funding for cooking projects, especially for ICS projects executed by NGOs and humanitarian organisations, but as the latest figures underline, they still represent a small niche market compared to other carbon credit investments. There have been two main sources of carbon credits. The first is the Clean Development Mechanism (CDM) which is managed through the United Nations Framework Convention on Climate Change (UNFCCC). This has been the main source of funding for compliance purposes under the 1997 Kyoto Protocol and is now under review after the 2015 Paris Agreement. Secondly, the ‘voluntary market’, which has operated in parallel as an alternative source of carbon credits for clean cooking projects, where mainly private firms can voluntarily offset their emissions. The majority of these crediting activities are still focused on the power and fugitive emission sectors, with an increasing share of investment in forestry projects, which now account for almost half of the investment.

Despite a significant growth of the carbon pricing sector, the application of carbon credit financing in the clean cooking sector has faced significant challenges. Markets have often been frustrating for project developers with prices fluctuating, complex procedures, high certification costs and projects sometimes finding it hard to attract funding at all. Carbon market prices, especially in the voluntary market, are highly variable and ranged from an average of around $2 to $12 t/CO2 in 2019, with an average of $3.5 t/CO2 paid in the clean cookstove market which is below the global benchmark.

Furthermore, the concept of offsetting has itself been very controversial, with commentators querying whether these incentives were really working to reduce emissions and how rigorous procedures were.

The majority of clean cooking companies which have been surveyed by a MECS study reported significant challenges when applying or implementing carbon credit financing for their respective businesses, leading to either giving up on pursuing this option or a much slower take-off than anticipated. Besides complex bureaucratic and organisational hurdles, which are especially challenging for smaller businesses located in the Global South, the pricing of the credits, repayment schemes and monitoring have been significant challenges for the sector.

Although carbon prices have increased in various jurisdictions over the past years, they are still substantially lower than needed to achieve consistency with the Paris Agreement objectives. As of 2019, it has been estimated that emissions have been priced at less than $10 t/CO2e, while the International Monetary Fund (IMF) calculated the global average carbon price at only $2 t/CO2, which sharply contrasts with the estimated $40 to $80/per tonne of CO2 by 2020 and $50 to $100 per t/CO2 by 2030 required to effectively reduce emissions in accordance with the Paris Agreement.

The move to modern energy cooking solutions has offered the chance for a simplification in calculating emission reductions using a smart data approach. The consultancy group ClimateCare has worked with MECS to develop a new methodology that simplifies the process of taking electrical and metered cooking appliances through the process of accessing carbon credits which have been approved by Gold Standard earlier this year.

In the past, the method for calculating emission reductions was based on quantifying emissions resulting from the quantum of fuel used in a sample of households and then calculating emission savings by comparing this with emissions similarly calculated after the project. The kitchen surveys, both baseline and follow-ups, had to be detailed and accurate, so they were typically carried out in 100 households or more and then repeated at least every two years. The process was time-consuming, expensive and open to errors in data collection. The new approach calculates emission savings for each unit of energy used in cooking, and so with actual usage monitored, calculations can be made simply and accurately. The installation of metering devices that monitor actual usage (and hence the equivalent of carbon reduction under the new procedure) may be technically challenging for ICS that still rely on biomass but should be manageable and economic for electrical and metered devices.

Given the strong global commitment to support climate change initiatives and the agreement from COP26 to boost green energy , the prospects for carbon credits arising from different sources appear very positive at the present time, which provides a strong incentive to identify opportunities to simplify procedures and reduce costs.

Climate-related funding is directly related to GHG emission reductions and is provided from sources dedicated to promoting these objectives. Clean cooking projects promote other strong positive SDG impacts, in particular for health improvements, gender impacts, environmental benefits from reducing black carbon emissions and biomass depletion, and livelihood benefits. These may provide opportunities for clean cooking projects to solicit support from other donors. Development Impact Bonds (DIBs) or outcome purchase programmes are one mechanism whereby such opportunities can be realised. DIBs extend debt capital to clean cooking companies in exchange for ownership rights to the outcomes created by the sale of the appliances or services. These outcomes or benefits are then verified and sold to outcome buyers (donors), thereby enabling the repayment of the debt, and effectively converting the loan into a grant for the clean cooking company. This form of RBF is at a very early stage but has the potential to scale significantly if it can be shown to be cost-effective and reliable in meeting donor objectives.

Barriers for many clean cooking companies to unlock carbon financing are substantial administrative hurdles, missing institutional links between clean cooking companies and carbon market players, challenges to estimate actual usage and carbon emission reduction (including black-carbon) and the ‘chicken-and-egg problem’ of carbon finance requiring projects at scale while being a substantial opportunity to scale-up the sector and to provide the opportunity of a wider range of actors in the sector to benefit from carbon financing mechanisms.

Consequently, for the clean cooking sector to benefit from carbon financing at scale, a simplified methodology, technical- and administrate assistance and proven processes are required in connection with cost-effective and reliable usage-tracking of the cooking devices.

………………………………………..

Sections of this article have been extracted from the following publication:

Stritzke, S., Sakyi-Nyarko, C., Bisaga, I., Bricknell, M., Leary, J., & Brown, E. (2021). Results Based Financing (RBF) for Modern Energy Cooking Solutions: an effective driver for innovation and scale? Energies, Special Issue: Clean Energy Innovations: Challenges and Strategies for Low and Middle Income Countries

The full-length article is available under: https://www.mdpi.com/1996-1073/14/15/4559

……………………………………….

Featured image: Visual Stories || Micheile on Unsplash