- Date

- 28th July 2023

- Categories

- Digital Financing, eMobility & eCooking

By Geoffrey Mburu (PowerPay), Joyce Kibe (PowerPay), Wairimu Njehia (Kenya Power), Jon Leary (MECS), Dan Hamza Goodacre (Integrate2Zero) & Irene Wanjohi (Kenya Power).

The eCooking and eMobility revolutions are sweeping across Kenya, with Kenya Power, the nation’s electricity utility driving change in the kitchen, as well as on the road via the grid. Both industries sit at the centre of Kenya Power’s demand growth strategy, as both have the potential to simultaneously offer cost savings to the consumer, whilst stimulating demand for the utility’s almost entirely renewable electricity. However, in both sectors upfront costs are a significant barrier constraining consumer demand. This blog tells the story of the development and piloting of an innovative consumer financing mechanism that could unlock this energy revolution at scale, the eCooking & eMobility Stima Loan.

Utility-enabled finance in Kenya

Utility-enabled finance (Waldron and Hacker, 2020) offers the potential to rapidly scale access to energy-efficient appliances amongst utility customers. Utilities are uniquely placed to offer credit to their customers by virtue of their existing relationships, which include brand loyalty, a supply chain for equipment (and maintenance services) and billing systems. When repayments for financed assets are made to the utility via its existing billing system for electricity units, this is known as on-bill repayments, or on-bill financing. However, utility-enabled financing can take many shapes and forms, with data sharing and co-marketing equally valuable services that the utility is uniquely placed to offer to appliance distributors and financiers hoping to sell to their customers.

The Stima Loan is a Kenya Power initiative designed to connect low-income families that cannot afford to pay the connection fees in one go by breaking it down into repayments made via the utility’s existing billing system. A pilot revolving fund was launched in 2010 and initially supplied with € 6 million through the French Development Agency, AFD. The project disbursed loans to 232,015 customers totaling Shs4,217,690,324 and resulted in the connection of 228,040 new customers. The project disbursed loans under two schemes:

- The Stima Loan

- The Last Mile Connectivity Project (LMCP)

Under Stima Loan, households without electricity access, but with a higher ability to pay and verifiable credit histories, were targeted and there was a 97% success rate in terms of connections made and a 91% full repayment rate.

Under the LMCP, there was a 99% connection rate, however, by 2019, only 23% had been fully repaid (53% have a partial repayment and 24% of had no repayments).

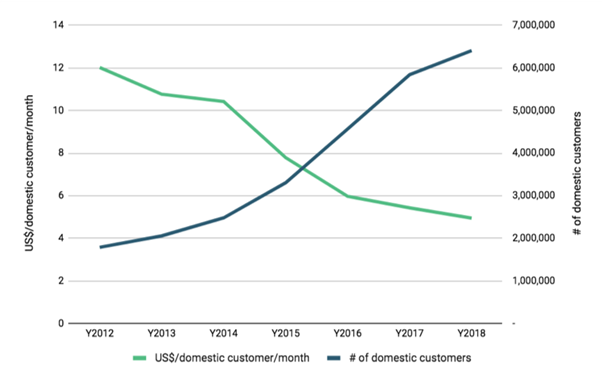

The LMCP was very successful in increasing Kenya Power’s customer base from under 2 million in 2011 to over 8 million in 2022, however the majority of this broader base of residential customers consume very little electricity — on average just 30 kWh/month per household (versus 150kWh/month in China or over 900kWh/month in the US). Low demand is compounded by the high cost of connecting new customers, who consume progressively less as the grid reaches into poorer and more remote regions of the country. This falling revenue per customer is increasingly a serious threat to KPLC’s business model and overall financial viability (Mutiso & Taneja, 2018).

A recent impact Evaluation of the AfDB-supported (African Development Bank) first phase of the Kenya Last Mile Connectivity Project (LCMP) concluded that the imbalance created by the low revenue generated from last-mile connections relative to the high cost of maintaining and operating an extensive electricity network, is placing a significant strain on the financial sustainability of KPLC (IDEV, 2022). It also observes that the electricity consumed by LMCP beneficiaries has remained low even after 2-3 years of connection to the grid. Beneficiaries are hindered by lack of financial resources to invest in electrical appliances that could increase the productive use of electricity. Thirdly, it found that the intervention did not affect the time women and girls spent in household chores, childcare, cooking, fetching firewood and water.

The study recommends that Kenya Power should actively stimulate households’ and businesses’ demand for the productive use of electricity. Cooking and mobility are key productive uses of energy that can enable Kenya Power customers to increase their income (and/or decrease their expenditures), whilst simultaneously stimulating demand for electricity and reducing greenhouse gas emissions. Kenya Power’s most recent annual report highlighted eCooking and eMobility as two key pillars at the core of the utility’s growth plan.

However, an EPC typically costs $100, whilst eBikes typically retail at over $1000, presenting a considerable barrier to uptake. Kenya Power is uniquely placed to help its customers overcome this barrier, but with the high default rate on the connection fee loans and limited revenue from electricity sales, it is understandably reluctant to put these products on its own balance sheet. Recent tariff increases also introduce sensitivities around loading additional payments onto customers’ already heavier bills. Nonetheless, it is actively pursuing partnerships with the private sector to unlock this vicious cycle of low demand and low revenue resulting in higher tariffs and even lower demand.

The eCooking & eMobility Stima Loan project was one of twelve projects funded under the eCooking Capacity Building & Market Development (eCAP) programme, which kicked off earlier this year as a collaboration between Kenya Power, MECS and UK PACT. Integrate2Zero joined as a strategic partner for this project, which enabled the purchase of the initial set of 200 EPCs and 2 eBikes to be sold on credit to Kenya Power customers.

The project is implemented by PowerPay (GIVE Limited), a digital solutions provider with an innovative solution to support the roll out of utility-enabled finance. PowerPay are able to ‘digitize’ conventional appliances by installing an interoperable widget that:

- Measures energy consumption, enabling Kenya Power to track the contribution of each appliance to their broader goal of demand stimulation.

- Can lock out the device remotely, enabling third party appliance distributors and financiers to work in partnership to offer PayGo appliances to Kenya Power’s customers.

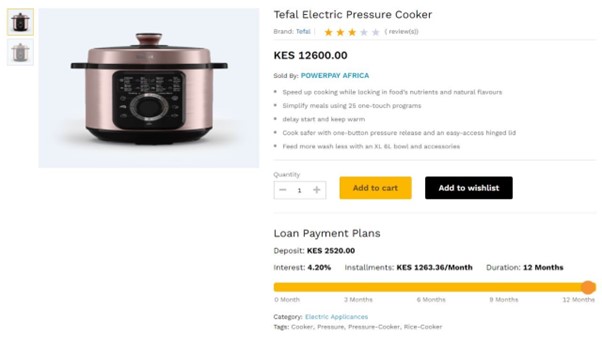

Above images show PowerPay’s first digitally financed eCooking & eMobility products which are available through their online platform, through partnerships with Groupe SEB (Tefal) and ARC Ride.

This project utilized an experimental design to test some of the hypotheses/assumptions that underpin the viability of extending utility-enabled financing from connection fees to appliances/vehicles. Working with an MFI expert, the loan product design was undertaken using various sources of data, incorporating the learnings from the Stima Loan experience. This included a literature review; key informant interviews; benchmarking from other financing institutions such as MFIs banks, SACCOS and other PAYGO companies; and most importantly, action research to obtain detailed feedback directly from the first batch of customers.

Customer acquisition was carried out in various parts of the country in collaboration with Kenya Power Regional Offices in Nakuru, Kisumu, Nyeri and Eldoret and a total of 12 awareness and consumer education activities have been conducted to date by leveraging key partnerships:

- 2 in Kiambu County targeting farm workers working with Coffee management Services.

- 2 in Njoro Nakuru County targeting farmers and a church-based initiative in collaboration with Farm Systems Kenya; and 4 within Nakuru town.

- 1 in Kisumu County in conjunction with Equity Bank and Nyalore Impact.

- 2 with refugees in Eldoret, Uasin Gishu County mobilized together with Nyalore Impact.

- 1 in Tharaka Nithi County with Thuita Farmers Cooperative Society.

- 1 in Maua, Meru County mobilized by Pan African Climate Justice Alliance.

- 3 conducted with Kenya Power Regional Officers in Kisumu, North Rift, Western.

The two images above shows the PowerPay and Kenya Power teams carrying out joint awareness campaigns on eCooking at Kibugua, Magumoni, Tharaka Nithi County (above) targeting Thuita Coffee Farmers’ Cooperative Society.

Initial findings

To date, a total of 350 potential customers have been reached with the product offering in various joint marketing and awareness forums set up by PowerPay and Kenya Power. Despite more men being reached by the marketing activities, only 21% of the customers benefiting from the product so far are men, while 79% are women.

| Male | Female | |

| Numbers reached | 191 | 159 |

| % reached by gender | 55% | 45% |

| % uptake by gender | 21% | 79% |

As part of the experimental design, customers have been allowed to choose different repayment periods based on their ability to pay. The most popular repayment period is the 12-month period, which was the longest offered. A lower percentage went for the 6-month period while the ones with a higher income group chose to pay in one instalment.

| Number of instalments selected | 1 | 2 | 6 | 12 |

| % in each category | 25% | 6% | 23% | 47% |

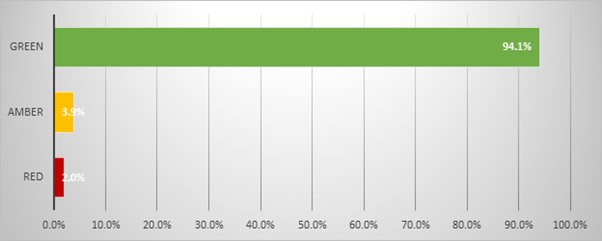

As shown in the below graph, the initial indications are positive, with 94% of customers making their repayments on time (green), while 4% of the customers paying their instalments at least 2 days later than expected repayment date (amber) and just 2% are considered receivables at risk (red).

Next steps

These initial sales have demonstrated the value of collaboration between the utility and the private sector to unlock latent demand in both the eCooking and eMobility sectors with utility-enabled financing. This has begun with collaborative marketing efforts, however data sharing can further enhance this mutually beneficial partnership. Data on additional electricity unit sales held by IoT solution providers is important for the utility, and data on payment histories held by the utility is important for financiers. Analysis of the data acquired during this project by PowerPay and Kenya Power together may pave the way for broader collaboration within the sector under the broad umbrella of utility-enabled financing.

Look out for more blogs sharing further insights from this project and more digitized appliances from the PowerPay team!