The report Making Carbon Finance work for Clean Cooking provides detailed information on how financing considerations can influence the finance partners chosen by a project developer as well as the transaction structure. How carbon revenues are to be used and the type of financing support a project developer requires can influence these arrangements. Table 3 provides an overview of transaction partners and their potential support arrangements.

| Particulars | Upfront Financing | Assistance with Carbon Project Development | Long term Offtake Agreement | Quick Transaction Support |

|---|---|---|---|---|

| Direct end-users of carbon credits | * | * | ||

| Carbon project aggregators | * | * | * | |

| Investment funds | * | * | ||

| Brokerage firms and traders | * | |||

| Carbon exchanges | * |

Project developers’ positioning in the carbon market will evolve over time as funding needs, access to finance conditions, distribution measures and the carbon market outlook change. They will also be influenced by their level of experience and consequent needs for advice and support together with their risk appetite. There are three main types of transaction structure. These structures differ in terms of their delivery conditions. Spot sales with guaranteed deliveries, and forward sales with future guaranteed and unguaranteed deliveries of carbon credits are the three types. Spot sales of available carbon credits offer the highest degree of certainty while forward sales present a mix of risk rewards to the developer and the buyer. From a developers’ perspective, the main factors influencing the decision of what contract terms to arrange may be their need for liquidity and their propensity to bear risk.

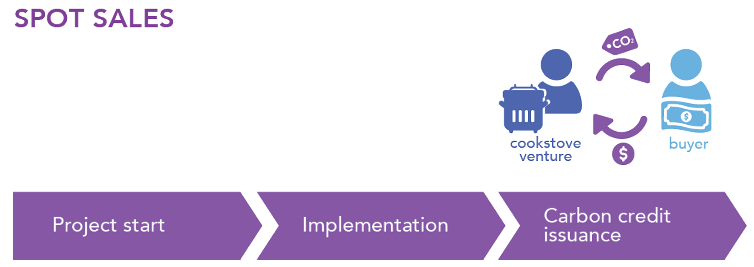

Spot Sales – Guaranteed Delivery of Credits

Once projects are registered and credits are issued, these can be sold in the market. This ability to promptly deliver carbon credits offers security to buyers, generally translating into higher pricing. Project developers may transact spot carbon credits directly to end-users. Intermediaries can also support spot sales, including brokerage firms, traders, and exchanges. While selling spot may help the negotiation power of the seller, not all project developers are able to wait several years before capturing the benefits of carbon finance. Furthermore, project developers would then shoulder the market risk associated with changes in pricing. Figure 3 shows the spot sales of carbon credits.

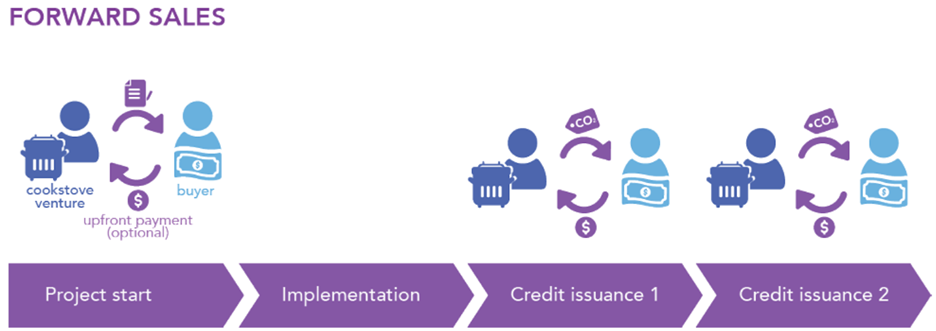

Forward Sales: Guaranteed and Non-guaranteed Delivery of Future Credits

Project developers can opt to lock-in a price for future carbon credits delivery to hedge against future uncertainties. A forward sale occurs when the project developers and buyers commit to transacting a volume of future carbon credits by a pre-defined time. Figure 4 shows the structure for forward sales of carbon credits. Where this future volume is non-guaranteed, project developers commit to deliver up to an agreed volume to the buyer, with the buyer taking on any under-delivery risk. However, this might result in a price discount on such forward sales.

Project developers can also offer a guaranteed future delivery, committing themselves to both a firm delivery schedule and delivery volume. Pricing of such guaranteed future deliveries will be higher. However, developers need to be careful, as any under deliveries will have financial implications. As such, guaranteed future deliveries are generally only offered by established project developers.

Pricing may be fixed, be indexed to inflation, or track the price development of a publicly traded standardised carbon contract on a recognised exchange. Forward contracts can be signed directly with end-users, which can be supported by aggregators, investment funds, as well as brokerage firms or even some exchanges. Parties can be willing to offer partial prepayments, allowing project developers to mobilise upfront financing to fund operations.

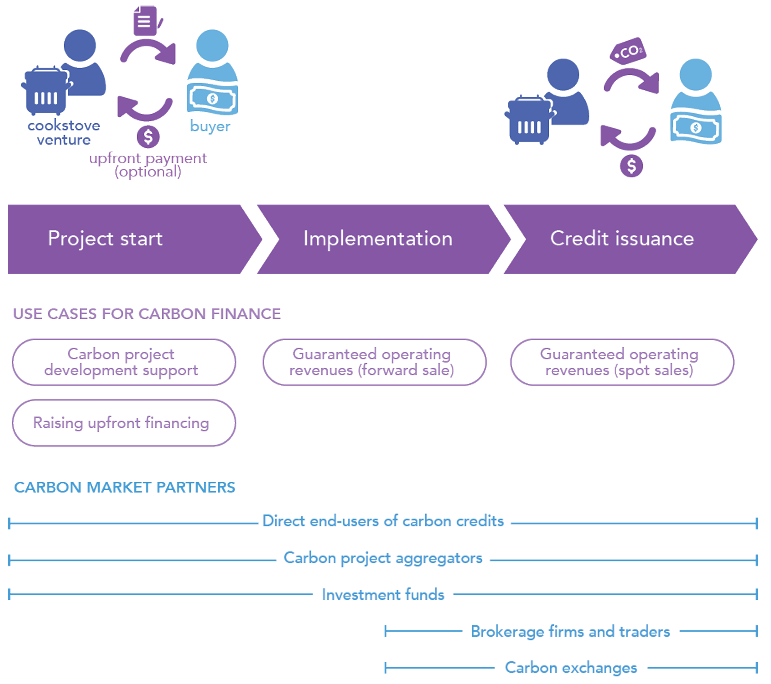

The ‘Use Case’ and Partner Choices

Project developers can ‘use’ carbon credits strategically to maximise revenues and to overcome barriers to market entry or scaling. This, in turn, guides the selection of partners, depending on the type of transaction which may range from one-off sales to long-term collaborations where partners bring technical or managerial expertise alongside upfront financing and premium prices. The decision of when and under which conditions to sell carbon credits will therefore be driven by project developers’ needs. Figure 5 shows the different use cases in relation to the role of different categories of carbon market partners.

Experienced carbon project developers can pursue new carbon projects independently and prioritise offering spot sales or guaranteed future deliveries. This may allow them to achieve a higher value. For project developers who are less experienced and/or with limited upfront financing, it may be better to pursue partnership with specialised intermediaries who can help with both the project development and access to upfront finance. This latter strategy is likely to translate into a significantly lower carbon revenue share especially where the carbon asset development process and carbon credit delivery risk is transferred to the partner organisation. However, developers would then gain the advantage of hedging price risk as well as the support of an experienced organisation to navigate them through a complex process.

…………………………

Click here to go back to the carbon financing main menu.